US Tariffs on India – An Opportunity for Pakistan?

The US President’s strategy to address his country’s trade deficit with various trading partners, has resulted in the imposition of reciprocal tariffs on these trading partners.

The US President’s strategy to address his country’s trade deficit with various trading partners, has resulted in the imposition of reciprocal tariffs on these trading partners.

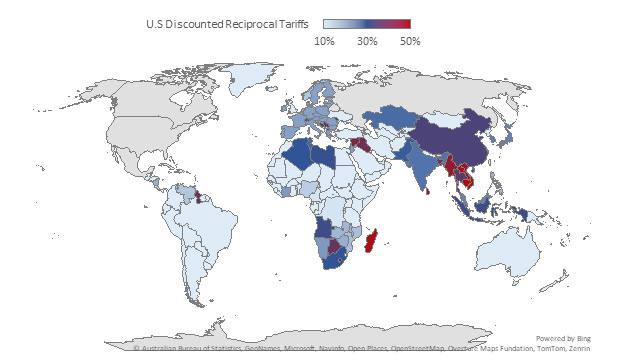

U.S Reciprocal Tariffs on all countries announced on April 2nd, 2025

Following the breakdown in negotiations and subsequent penalties for the import of Russian crude, India currently faces a tariff of 50% on most of its goods entering the US. In contrast, Pakistan’s reciprocal tariff rate was lowered to 19%. This gives Pakistan a substantial advantage over India, which is expected to make Pakistani goods significantly cheaper for US importers on an ad-valorem basis.

Overview of Reciprocal Tariffs as of October 27th, 2025

| Country | Reciprocal Tariff Rate announced on April 2nd, 2025 | Status of reciprocal tariff as on October 27th, 2025 | Current tariff rate |

|---|---|---|---|

| Bangladesh | 37% | Lowered to 20% | 20% |

| China | 34%, increased to 84% then 125%, then decreased to 10% | In effect; set to increase to 30% on November 10, 2025 | 30%+ |

| India | 26% | Lowered to 25%; increased to 50% on August 27, 2025 | 50% |

| Pakistan | 29% | Lowered to 19% | 19% |

| Vietnam | 46% | Lowered to 20% | 20% |

| Source: USTR, Avalara | |||

This analysis evaluates the potential for Pakistan to replace some of India’s exports to the US, noting that India’s trade with the US was approximately 17.8 times that of Pakistan’s trade with the US in 2024, and India’s exports comprise a highly diversified basket of high-value and medium-value goods, whereas Pakistan’s exports are heavily concentrated in low-value added manufactured goods.

The most compelling opportunity for Pakistan is in the textile sector, which already constituted 76.8% of Pakistan’s total exports to the US in 2024. Based on current US imports from Pakistan, the market gap potential across 14 key textile product lines is estimated to be between $715 million and $2.86 billion, if US imports from India decrease anywhere between 25% & 100%. Price competitiveness is a key driver, as 18 of Pakistan’s top 20 textile exports to the US are expected to have a lower per-unit price than Indian equivalents under the current tariffs. Products expected to benefit most include HS-63026000 ‘Toilet linen and kitchen linen …’, HS-63023190 ‘Bed linen, not knit/croc …’, and HS-61091000 ‘T-shirts, singlets, tank tops …’ , where Pakistan already has existing major exports to the US.

Beyond textiles, secondary opportunities exist in the agriculture and engineering sectors, although Pakistan’s current export volumes in these areas are much smaller. In agriculture, 15 out of Pakistan’s top 20 agri-exports to the US will be cheaper than Indian alternatives post-tariff, these include frozen fish fillets and dried fruits, however, Pakistan’s export volumes in these high-potential items are currently very low. Similarly, 14 of Pakistan’s top 20 engineering exports are expected to be cheaper than Indian alternatives, but this sector currently represents only 3.86% of US total imports from Pakistan and includes categories with less than $10 million in current exports.

It is very important to note that the US Tariffs is still a developing topic and India and the US are still negotiating to come to an agreement, hence there is a possibility that India will be able to achieve a trade deal with the US with a lower tariff.

The PBC is a private sector not-for-profit advocacy platform set-up in 2005 by 14 (now 100+) of Pakistan’s largest businesses. PBC’s research-based advocacy supports measures which improve Pakistani industry’s regional and global competitiveness. More information about the PBC, its members, objectives and activities can be found on its website: www.pbc.org.pk

Download